Through 7 company buys China vanke a, Chairman Xu jiayin, evergrande group holds shares of vanke had up to 5%, triggering the first placards. Late for 10 years and finally approved cervical

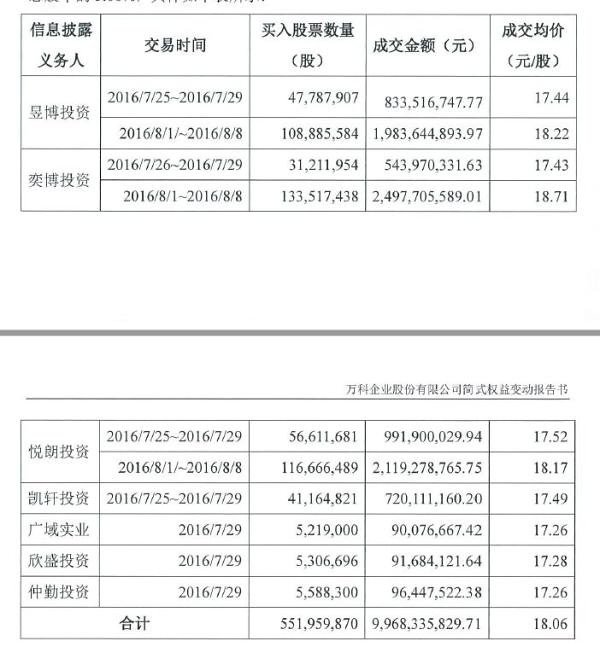

The evening of August 8, vanke a (000002) announced on July 25, 2016, between August 8, 2016, evergrande through 7 companies invest 9.97 billion yuan total buying vanke shares 5%.

Vanke rose 4.39% to 21.87 Yuan a day continue, at current prices, evergrande has shares worth 12.07 billion yuan, Ying 2.1 billion float. Shares reached 25.4% treasure floating profit also rose further, it is expected to reach 17 billion yuan.

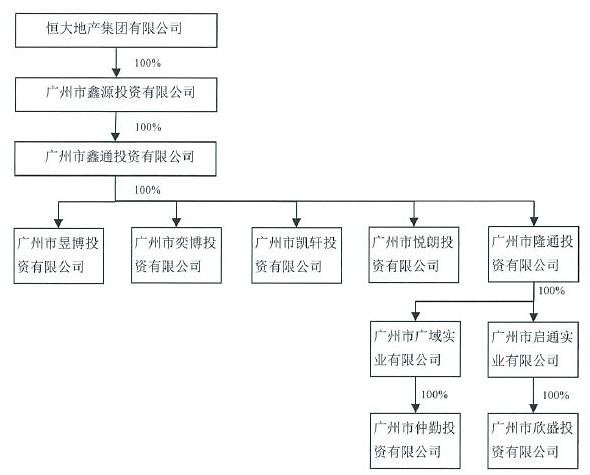

This 7 home company respectively is Guangzhou Yu Bo investment limited, and Guangzhou City Wilson Bo investment limited, and Guangzhou Hyatt lang investment limited, and Guangzhou Kay Xuan investment limited, and Guangzhou City wide domain investment limited, and Guangzhou City Hin Sheng investment limited, and Guangzhou City Jones Lang LaSalle service investment limited, according to announcement, vanke Yu August 8 received above information disclosure obligations people of vanke Enterprise Corporation Jane type interests changes report book. The disclosure duty arising from the same actual control of evergrande real estate group limited control and people acting in concert.

Announcement mentioned, Xu jiayin 7 companies started buying vanke as early as July 25, 2016, to August 8, 2016, centralized bidding system to increase its stake in the company through the Shenzhen Stock Exchange a-shares of 551,959,870 shares, accounting for 5% of the total shares of the company.

In accordance with the provisions of the securities laws, investment holding of shares of a listed company at 5%, starting on the date of the facts in the 3rd, to the State Council securities regulatory bodies, stock exchanges to provide a written report, notify the listed companies and make an announcement, and fulfil their obligations under relevant provisions of the law, known as the "card".

Previously, China on August 4 evergrande (03333. HK) buy vanke a exposure at a cost of more than 9 billion yuan. Constant announcements on the day, has, through its subsidiary companies in the market to buy some 516 million shares of vanke a-share, 4.68% per cent of vanke's total issued share capital, total costs of about 9.11 billion yuan, acquisition costs of 17.63 Yuan/share.

This figure, on August 5 to August 8 two days, evergrande has continued to aggressively spree vanke a-36 million shares in capital markets.

Evergrande said placards main purpose is authorized the investment value of China vanke a, within the next 12 months, vanke, according to the securities market as a whole and combined with a business and their stock prices and other factors, to decide whether overweight and underweight. With constant into and prospect even more puzzling for vanke executives grab.

At present, vanke a can for the treasure of the largest shareholder, holding 25.4%, China resources holding 15.24%, Ampang 6.18% stake.

No comments:

Post a Comment